Page Navigation

State Legislation

Companies engaged with Iran directly support and strengthen a dangerous regime that is developing a nuclear weapons capability to extort the international community, brutally repressing its own people, and sponsoring terrorism worldwide. U.S. state governments, which manage trillions of dollars of taxpayer money, can play a major role in ending these irresponsible business dealings by divesting from, and, denying contracts to, companies that do business in Iran.

The divestment and procurement bans undertaken by U.S. states have proven to be an effective bulwark against efforts to relax American economic pressure against the Iranian regime - even and especially during the Joint Comprehensive Plan of Action (JCPOA) from 2015. Today, two-thirds of U.S. states continue to renew legislation on their books specifically targeting companies that invest in Iran. As mandated in each state’s laws, ‘watch-lists’ for divestment are regularly updated and are a vital slice of public pressure forcing corporations to pay serious attention at the state level.

Learn which states have enacted legislation or policies to ensure that taxpayer funds do not go to companies doing business with Iran.

State Legislation

-

Alaska

Divestment Measures:

Policy: Resolution to Divest Interest in Companies Doing Business in Iran (September 20, 2012). State Bodies Affected: Alaska Retirement Management Board. Prohibited Companies: 45 companies (as of September 30, 2014). Amount Divested: $15 million (as of November 2012).

-

Arizona

Divestment Measures:

Legislation: House Bill 2151 (May 23, 2008), Chapter 63, Laws of 2012 (March 21, 2012). State Bodies Affected: State Retirement Systems, Public Safety Personnel Retirement System.

-

California

Contracting Legislation:

Iran Contracting Act of 2010 (AB1650): Signed into law on September 30, 2010). The act precludes all public entities in the State of California from renewing or entering into contracts of $1 million or more with companies that have substantial business in Iran's energy or financial sector.

Supplemental Legislation:

Insurance Divest from Iran Act (AB 2160): Signed into law on September 23, 2012). This law requires insurance companies licensed by the State Insurance Commissioner to divest any holdings in stocks or bonds of any foreign company actively engaged and invested in the Iranian energy sector, or any aspect of developing Iran's military or nuclear programs.

Divestment Measures:

Legislation: Assembly Bill 221 (October 14, 2007), Assembly Bill 2160 (September 23, 2012). \State Bodies Affected: California Public Employees' Retirement System (CalPERS). Report: California Public Divest from Iran Act Annual Legislative Report (December 31, 2014). Prohibited Investment: 4 companies (as of December 31, 2014). Amount Divested: $160 million (from companies involved in either Iran or Sudan).

-

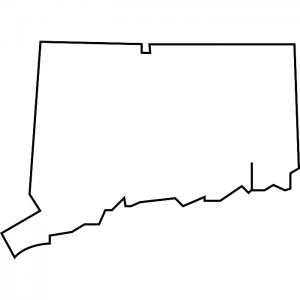

Connecticut

Contracting Legislation

Iran Contracting Law Act (HB5358): Signed into law on July 21, 2013). The bill prohibits people or entities that invest more than $20 million in goods, services or credit in the Iranian energy sector from entering or renewing contracts with State of Connecticut.

Divestment Measures

Legislation: P.A. 11-82 (July 8, 2011) State Bodies Affected: Connecticut State Funds, Connecticut Retirement Plans and Trust Funds (CRPTF) (Non-binding, at discretion of State Treasurer). Report: State Treasurer Report on Iran Initiative (April 30, 2014). Prohibited Investment: 14 companies (as of September 5, 2013). Amount Divested: $34.7 million.

-

Florida

Contracting Legislation:

Scrutinized Companies Act (SB 444): Signed into law on June 2, 2011. This law prohibits a company on the Scrutinized Companies with Activities in Sudan List or on the Scrutinized Companies with Activities in the Iran Petroleum Energy Sector List from bidding on, submitting a proposal for, or entering into or renewing a contract with an agency or local governmental entity for goods or services of $1 million or more. This includes requiring the State Board of Administration to divest current holdings in the Florida Retirement System portfolio and prohibits new investments in the securities of scrutinized companies.

Scrutinized Companies Act Amendment (SB 10-C): Signed into law on November 13, 2023. This amendment to the Scrutinized Companies Act expands the definition of “scrutinized company” with activities in Iran, renaming the list as the “Scrutinized Companies with Activities in Iran Terrorism Sector List.” As such, this list now includes any company doing business with the government of Iran in the energy, petrochemical, financial, construction, manufacturing, textile, mining, metals, shipping, shipbuilding, or port sectors. This amendment maintains existing statutory restrictions and requirements established under the Scrutinized Companies Act, while broadening their application.

Supplemental Legislation:

Iran Banking Certification Act (SB 792): Signed into law on May 4, 2012. The law requires that Florida state-chartered banks certify that their corresponding banks are not engaged in proscribed activities with Iranian linked financial institutions.

Divestment Measures:

Legislation: Senate Bill 2142 (June 8, 2007). State Bodies Affected: State Board of Administration. Report: Protecting Florida's Investment Act (PFIA) Quarterly Report (December 9, 2014). Prohibited Investment: 36 companies (as of December 9, 2014). Amount Divested: $1.306 billion (from companies involved in either Iran or Sudan).

-

Georgia

Divestment Measures:

Legislation: Senate Bill 451 (May 14, 2008). State Bodies Affected: All Georgia Retirement Systems. Reports: Georgia Employee Retirement Systems' Report 2012 (August 14, 2012). Prohibited Companies: 27 scrutinized companies listed as subject to divestment.

-

Illinois

Divestment Measures:

Legislation: Senate Bill 1621 (September 11, 2007). State Bodies Affected: State Retirement Systems, State Board of Investment. Report: Iran Act Annual Report of the State Board of Investment (January 1, 2015). Prohibited Investment: 61 companies (as of January 1, 2015). Amount Divested: $133 million (Retirement Systems), $7.08 million (Board of Investment).

-

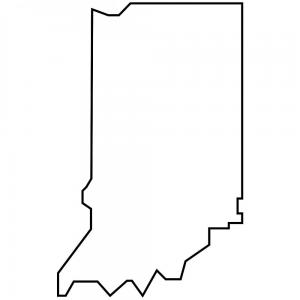

Indiana

Contracting Legislation:

Senate Bill 231 (Signed into law on March 6, 2012). The law prohibits people or entities that invest more than $20 million in goods, services or credit in the Iranian energy sector from entering or renewing contracts with Indiana State or local governmental entities.

Divestment Measures:

Legislation: H.B. 1547 (May 1, 2009). State Bodies Affected: Public Employees' Retirement Fund, State Teachers' Retirement Fund. Reports: Annual Report of the Pension Management Oversight Commission (November 2012). Prohibited Companies: 16 scrutinized companies listed as subject to divestment (involved with state-sponsors of terror as defined by the United States' Secretary of State).

-

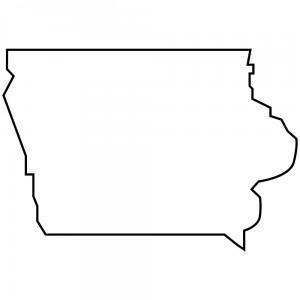

Iowa

Divestment Measures:

Legislation: House File 484 (April 20, 2011). State Bodies Affected: All State Entities, State Pension Funds. Report: Annual Report on Iran Divestment (September 29, 2014). Prohibited Investment: 35 companies (as of April 27, 2014).

-

Louisiana

Divestment Measures:

Policy: House Bill 864 (July 9, 2007). State Bodies Affected: State Pension Systems.

-

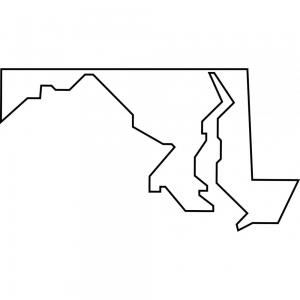

Maryland

Contracting Legislation:

Senate Bill 235: Procurement - Investment Activities in Iran (Signed into law on May 22, 2012). The law prohibits prohibit an individual, financial institution, or company that provides goods and services or a line of credit worth at least $20 million to the energy sector of Iran from entering into a contract with any public body of Maryland.

Divestment Measures:

Legislation: Senate Bill 214 (May 13, 2008) State Bodies Affected: All State Pension Systems. Report: Implementation of the 2008 Divestiture from Iran and Sudan Act (March 31, 2014). Prohibited Investment: 6 companies (as March 18, 2014).

-

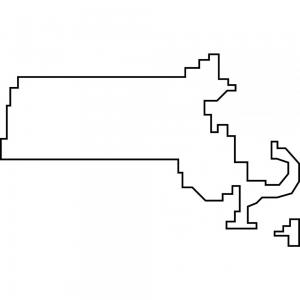

Massachusetts

Divestment Measures:

Legislation: House Bill 2470 (August 5, 2010). State Bodies Affected: State Pension Management Board. Reports: Massachusetts Pension Fund Finalizes Iran Divestment (January 3, 2012). Funds Divested: $100 million.

-

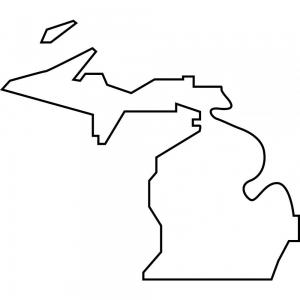

Michigan

Contracting Legislation:

Iran Economic Sanctions Act (SB 1024): Signed into law on December 28, 2012. The law prohibits prohibit an individual, financial institution, or company that provides goods and services or a line of credit worth at least $20 million to the energy sector of Iran from entering into a contract with any public entity of Michigan.

Divestment Measures:

Legislation: House Bill 4093 (July 15, 2008). State Bodies Affected: State Pension Funds. Report: Divested Securities (October 8, 2014). Prohibited Investment: 11 companies. Amount Divested: $185.4 million.

-

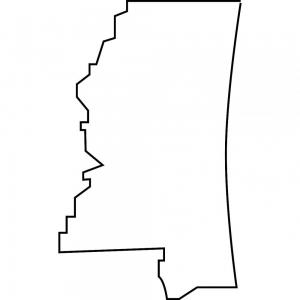

Mississippi

Contracting Legislation and Divestment Measures:

Iran Divestment Act of 2015 (HB 1127): Signed into law on April 23, 2015. The law prohibits state agencies from making certain investments and contracts with persons deemed to be engaged in providing goods or services to the energy sector of Iran.

-

Missouri

Divestment Measures:

Legislation: Implements a terror-free invest fund, screening out companies with ties to regimes involved in terrorism like Iran (July 2006). State Bodies Affected: Missouri Investment Trust.

Policy: "...the State Treasurer's Office seeks to promote and support the objectives of US foreign policy regarding terrorism. Accordingly, investments in companies or their subsidiaries or affiliated entities that are known to sponsor terrorism or aid the government in countries that are known to sponsor terrorism are prohibited." (2006). State Bodies Affected: Missouri State Employees' Retirement System (MOSERS).

-

Nevada

Divestment Measures:

Legislation: Assembly Bill 493 (June 2, 2009). State Bodies Affected: Public Employees' Retirement Board (non-binding). Reports: Pursuant to Reporting Requirements Outlined at NRS. 286-723 (January 8, 2013). Funds Divested: $39 million. Prohibited Companies: 4 scrutinized companies listed as subject to divestment.

-

New Jersey

Contracting Legislation:

New Jersey Iran Contracting Act (S1304) (Signed into law on July 30, 2012). The law prohibits New Jersey government contracting units from entering into contracts with companies doing business with Iran's energy sector. A person wishing to secure a contract with the state, counties, or municipalities must certify to the state treasurer that they are not doing business in excess of $20 million with Iran's energy sector.

Divestment Measures:

Legislation: Assembly Bill 3043 (January 4, 2008) State Bodies Affected: State pension funds or annuities. Report: Iran Progress Report (March 3, 2014) Prohibited Investment: 37 companies Amount Divested: $964.56 million

-

New York

Contracting Legislation

Iran Divestment Act of 2012 (A08668) (Signed into law on January 13, 2012) The bill prohibits people or entities that invest in goods, services or credit in the Iranian energy sector from entering or renewing contracts with New York State or local governmental entities. New York's Office of General Services will create a list of identified violators. Prohibited Companies: 34 companies prohibited from contracting with the state (Oct. 14, 2014).

Divestment Measures

Policies: New York State Comptroller Action (June 30, 2009), New York City Comptroller Action (July 20, 2009). State Bodies Affected: New York State Common Retirement Fund, New York City Pension Funds. Amount Divested: $86 million (New York State), $140 million (New York City).

-

North Carolina

Divestment Measures:

Policy: State Treasurer Decision (July 19, 2012). State Bodies Affected: North Carolina Retirement Systems.

-

Ohio

Divestment Measures:

Policy: OPERS Iran and Sudan Divestment Policy (September 12, 2007). State Bodies Affected: Ohio Public Employee Retirement System (OPERS).

-

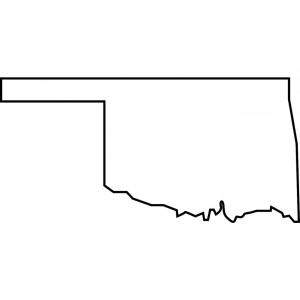

Oklahoma

Divestment Measures:

Legislation: H.R. 1026 (May 17, 2007). State Bodies Affected: State Retirement Systems (NonBinding).

-

Oregon

Divestment Measures:

Legislation: H.B. 4110 (March 27, 2012). State Bodies Affected: State Treasurer's Office, Oregon Investment Council.

-

Pennsylvania

Contracting Legislation:

Iran-Free Procurement Act (HB 201): Signed into law on October 21, 2014. The law bars any company that invests more than $20 million in any Iranian energy-related activities from entering into a state procurement contract worth more than $1 million through the Pennsylvania Department of General Services.

Divestment Measures:

Legislation: Senate Bill 928 (July 2, 2010). State Bodies Affected: State Treasurer's Office and State Retirement Systems. Report: 2014 Annual Divestment Report (September 30, 2014). Prohibited Investment: 34 scrutinized companies (as of July 2014). Amount Divested: $48.5 million.

-

Rhode Island

Contracting Legislation:

Iran Divestiture Act (S521): Signed into law on July 11, 2013. The bill prohibits people or entities that invest more than $20 million in goods, services or credit in the Iranian energy sector from entering or renewing contracts with State of Rhode Island. New York's Office of General Services will create a list of identified violators.

Divestment Measures:

Legislation: Senate Bill 521 (July 11, 2013). State Bodies Affected: State Retirement Board, State Investment Commission.

-

South Carolina

Contracting Legislation:

Iran Divestment Act of 2014 (H. 3021): Signed into law on June 5, 2014. The law prohibits state agencies from making certain investments and contracts with persons deemed to be engaged in investment activities in Iran. State Bodies Affected: Retirement System Investment Commission, State Treasurer Prohibited Companies: 41 companies prohibited from contracting with the state (January 5, 2015).

-

South Dakota

Divestment Measures:

Legislation: Senate Bill 134 (March 29, 2010). State Bodies Affected: All public funds, State Pension Funds. Report: 2014 Annual Report (January 13, 2015). Prohibited Investment: 36 scrutinized companies (as of December 31, 2014).

-

Tennessee

Contracting Legislation

Iran Divestment Act (T.C.A. § 12-12-101): Signed into law on July 1, 2016. This title requires the state chief procurement officer to publish a list of persons and entities determined to be engaged in investment activities with Iran on the state’s website. Those included on this list are prohibited from contracting with any political subdivision of this state and any contract entered into shall be void

Divestment Measures

Legislation: T.C.A. § 12-12-101 State Bodies Affected: any political subdivision of the State of Tennessee. Prohibited Investment: 31 companies (as of August 24, 2021).

-

Texas

Divestment Measures:

Policy: Texas Governor Divestment Announcement (September 25, 2007). State Bodies Affected: The Employees' Retirement System and Teachers' Retirement System.

-

Utah

Divestment Measures:

Legislation: Senate Bill 112 (March 28, 2011). State Bodies Affected: Utah Retirement Systems.

-

Washington

Divestment Measures:

Policy: WSIB Resolution on Iran Investment (March 2008). This resolution expired on June 30, 2011. State Bodies Affected: Washington State Investment Board (WSIB).

Contracting Legislation

In July 2011, UANI unveiled model Iran contracting inititiatives to legislative leadership in all U.S. states. The model legislation would bar companies and financial institutions from doing business in U.S. states and receiving U.S. state government contracts if they continue "business as usual" in Iran. The prospect of debarment is one of the most effective ways to compel corporations to end their Iran business. Collectively, state governments offer billions of dollars in contracts every year. No responsible and profit-driven company would jeopardize millions if not billions of dollars of government contracts by continuing to do business in Iran. Fourteen states - California, Florida, New York, Illinois, Indiana, Maryland, Michigan, Mississippi, New Jersey, North Carolina, Pennsylvania, Rhode Island, Connecticut, and South Carolina - have subsequently passed legislation that precludes all public entities from renewing or entering into contracts with companies invested in sensitive sectors of Iran’s economy.

Divestment Legislation/Policies

Thirty-two states and D.C. have enacted divestment legislation or policies. These measures have resulted in billions of dollars being pulled out of international corporations that do business with Iran’s dangerous regime. Considering that in 2021 U.S. state and local pension funds held combined assets of nearly$4.5 trillion, the economic costs for these companies that continue to do business with Iran in the face of such losses can compel them to end their support of the Iranian regime and pull out of the country. The Comprehensive Iran Sanctions, Accountability, and Divestment Act ("CISADA"), enacted in July 2010, gives state and local governments express legal permission to divest from companies that do business with Iran's energy sector.

Banking Legislation

UANI also supports efforts by the U.S. states to compel banks, insurance companies, and other financial institutions to divest themselves of all Iran business. U.S. financial institutions and insurance companies are regulated by the respective states in which they are licensed. Florida is the first state to take such action through the Iran Banking Certification Act, which gives the state authority to mandate that all state-chartered banks certify that their correspondent banks are not engaged in proscribed activities with Iranian linked financial institutions.

Insurance Legislation

States can also take action to require that insurance companies licensed by the State Insurance Commissioner will not hold stocks in or bonds of any foreign company actively engaged and invested in the Iranian energy sector, or any aspect of developing Iran’s military or nuclear programs. California is the only state with insurer-specific legislation.

The sentiment behind these additional measures is clear: banks and insurance companies with ties to the Iranian regime should not have access to U.S. states financial markets and/or U.S. financial institutions.

State Authorization Legislation

Overall, states and local communities are inspired to take meaningful action to prevent a nuclear-armed Iran. UANI has therefore proposed model legislation, for adoption by the federal government that would explicitly authorize a state or local governments to adopt and enforce measures to economically isolate the Iranian regime. States should be authorized to determine how their funds or assets are allocated to entities with Iran business activities, and be given authority to support and further U.S. national policy on sanctioning Iran as memorialized in federal Iran sanctions law.

UANI Model Legislation

Letters

- UANI's July 14, 2011 Letters to All 50 U.S. Governors and Majority and Minority State Congressional Leaders, Urging Them to Pass State Certification Legislation

Press Releases

- "UANI Applauds Michigan for Passing Iran Debarment Law" (December 20, 2012)

- "UANI Applauds New Jersey for Passing Iran Debarment Legislation" (August 3, 2012)

- "UANI Applauds State of Maryland for Unanimously Passing Iran Debarment Legislation" (April 9, 2012)

- "UANI Applauds Indiana General Assembly for Passing Iran Contract Debarment Law" (February 23, 2012)

- "UANI Applauds Maryland Governor Martin O'Malley, State Lawmakers for Introducing Iran Debarment Legislation" (February 9, 2012)

- "UANI Applauds Indiana General Assembly for Introducing Iran Contract Debarment Law" (January 18, 2012)

- "UANI Applauds New York's Iran Contracting Act of 2012" (January 9, 2012)

- "UANI Applauds New York Assembly Speaker Sheldon Silver for Introducing State Certification Legislation" (October 27, 2011)

- "UANI Urges New York Assembly and Senate to Pass Iran Debarment Legislation" (October 26, 2011)

- "UANI Calls on States and Municipalities to Pass Legislation Debarring Contractors Doing Business in Iran" (July 14, 2011)

- "UANI Applauds State of California for Pressuring ABB to End Its Oil and Gas Business in Iran" (July 7, 2011)

- "UANI Applauds Layher, California Contractor, for Ending Its Business in Iran" (June 29, 2011)

- "In Case You Missed It: UANI's California Debarment Legislation Featured in Financial Times" (June 27, 2011)

Earned Media

- Wall Street Journal: "Uniting States Against Iran" (March 8, 2013)

- Washington Jewish Week: "Maryland targets Iran" (April 11, 2012)

- Wall Street Journal: "New York Legislature Passes Iran Sanctions Bill" (January 9, 2012)

- The Forward: "State Lawmakers Ramp Up Anti-Iran Push" (November 24, 2011)

- UPI: "Iran sees trade booming despite sanctions" (July 15, 2011)

- Financial Times: "California tightens screw on trade with Iran" (June 27, 2011)